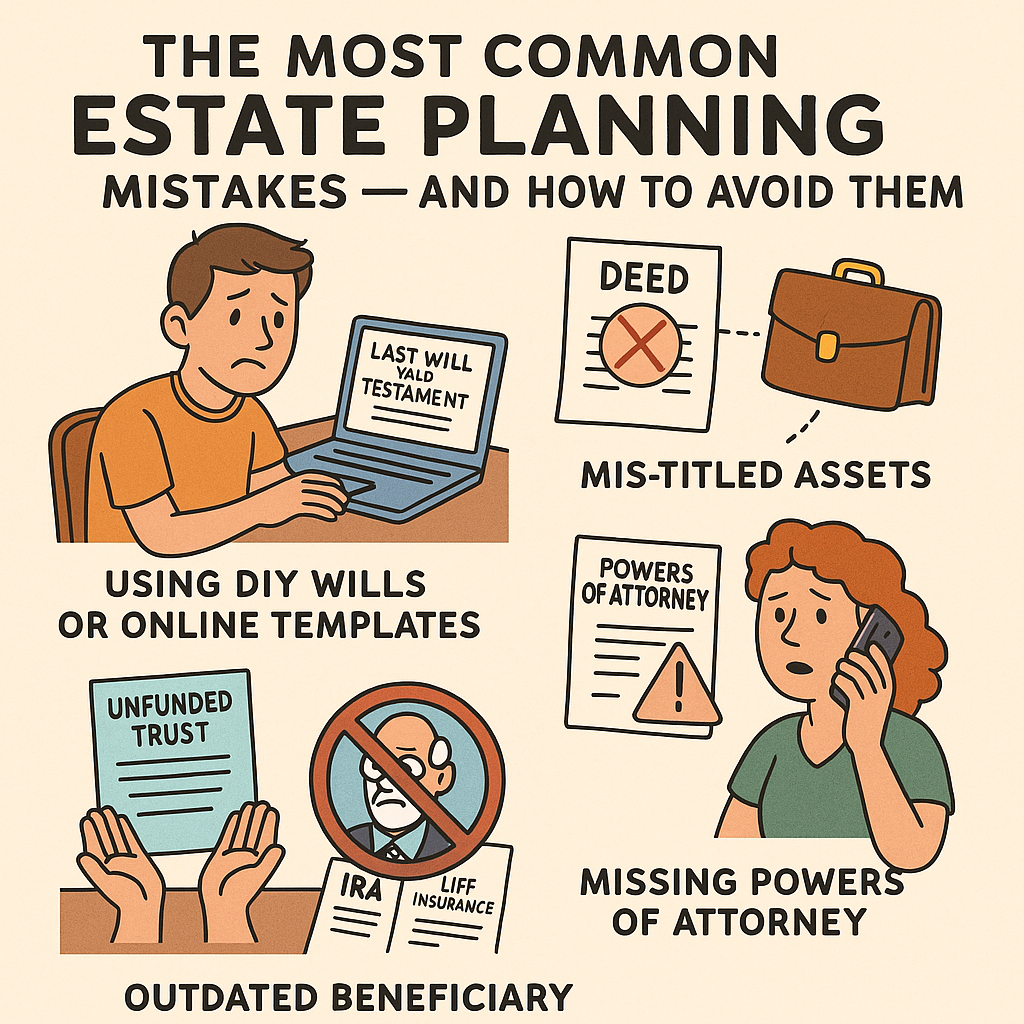

The Most Common Estate Planning Mistakes — and How to Avoid Them

By The Simon Law Group – The Law Firm That Protects You

A strong estate plan protects your family and your assets — but only if it’s done correctly. At Simon Law Group, we often see simple mistakes that cause major complications later. Here are the most common pitfalls and how to avoid them.

- Using DIY Wills or Online Templates

DIY wills rarely meet New Jersey’s legal standards and often leave families with costly disputes. They typically overlook taxes, complex assets, blended families, and proper execution. A professionally drafted will ensures your wishes are clear and enforceable.

- Mis-Titled Assets

Your documents only work if your assets are titled correctly. Mistakes like joint accounts, outdated deeds, or improperly titled business interests can override your intentions. Proper coordination keeps everything aligned with your plan.

- Unfunded Trusts

A trust is useless if nothing is transferred into it. Unfunded or partially funded trusts do not avoid probate or protect assets. Funding your trust is essential — and we help clients complete this step correctly.

- Outdated Beneficiary Designations

Beneficiary designations on retirement accounts and life insurance override your will. After major life changes — divorce, remarriage, new children — failing to update them can result in assets going to the wrong person.

- Missing Powers of Attorney

Without financial and medical powers of attorney, your family may need court approval to act on your behalf during an emergency. These documents ensure someone you trust can step in immediately if needed.

Protect Your Plan — Protect Your Family

Estate planning is more than drafting papers — it’s making sure everything works together. The Simon Law Group helps clients create complete, updated, legally sound plans that truly protect their loved ones.

Ready to review or update your estate plan? Contact us to get started.

Call today 800-709-1131 for a free consult or text us at 908-864-4450